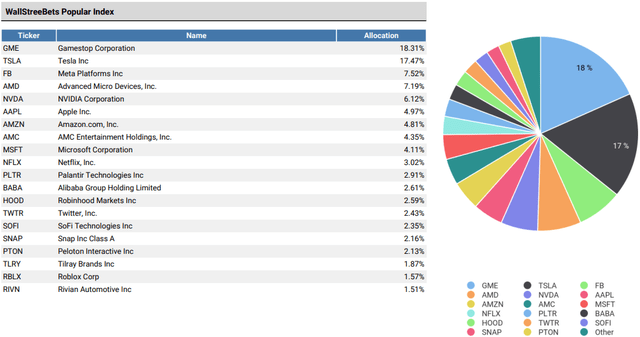

Let me know if you have any questions about the strategy and congratulations on your outstanding returns. Note the bar sizes increasing and decreasing depending on how much capital we have to invest. I initially considered examining the sentiment behind discussion of different tickers and constructing a market-neutral portfolio, but decided that taking short positions sounded like some bear shit and chose to steer clear.īelow is a visualization showing what the portfolio looked like every week. Sell positions at the end of the trading week.With the /live/wallstreetbets method, you can see all mention counts in a date range using dateto and datefrom. Buy those stocks at the start of the trading week, sizing positions based on how much they were talked about in proportion to each other. The Quiver API is based on REST, has resource-oriented URLs, returns JSON-encoded responses, and returns standard HTTP response codes. The WallStreetBets dataset by Quiver Quantitative tracks daily mentions of different equities on Reddit’s popular WallStreetBets forum.We're bringing it to your phone, for free. Identify the five most mentioned stocks. Wall Street spent over 2 billion on alternative data last year. WallStreetBets & CNN Fear and Greed Index (Quiver Quantitative) Alphabet (GOOG), Lucid Group (LCID), PayPal Holdings (PYPL).Get data on previous week’s WallStreetBets discussion from Quiver Quant API.I don't need to give you an introduction into what's been going on here, so I'll get right into the pretty pictures. Hours respective to their own timezone.įor the past few months, I've been testing a strategy that is based around discussion on WallStreetBets.Read the FAQ if you're new to both wallstreetbets and trading. Boosted by retail investors despite an absence of good news, the company’s stock has jumped 41% so far this year, compared to a 19% loss for the SPDR S&P Retail ETF and a 10% loss for the broader S&P 500 index.The rules and submission guidelines are maintained on new Reddit so be sure to check them and make sure you're up to date. After he pushed for change at the company and a turnaround in the business, Bed Bath & Beyond CEO Mark Tritton was replaced in late June following yet another batch of bad financial results. What Happened: Microvision which works on laser scanning, 3D sensing, and projection technology was the most mentioned stock on a 24-hour basis on WallStreetBets, according to Quiver. Key Background:Īctivist investor Ryan Cohen first revealed a roughly 10% stake in the company back in March. She insists that the stock continues to trade at “unrealistic valuations,” though the recent rally could provide the company with a “long-term lifeline” if it raises money from stock sales similar to other meme stocks like GameStop and AMC. Riley Financial analyst Susan Anderson wrote in a note to clients. Were bringing it to your phone, for free. Strategy: Joined 8/2020 0 Following 3.2k Followers 73,102 Posts 6 Liked 4 Watchlist Portfolio Introducing Litepaper, a newsletter by Stocktwits. By parsing discussion on this forum, we can track which companies retail investors are mentioning the most, and the sentiment of the discussion around each ticker. Quiver Quantitative (QuiverQuant) Stocktwits QuiverQuant Quiver Quantitative Bridging the data gap between Main St. The stock has “recently gained the attention of retail traders in the Wall Street Bets Reddit forum again, which gained notoriety during the GameStop saga back in January 2021,” B. Quiver r/WallStreetBets Strategy Analysis Here is a brief overview of our analysis describing two types of trading strategies built using Quiver Quantitative’s WallStreetBets API. WallStreetBets is a community on Reddit where participants discuss stock and option trading. Click to read WallStreetBets Daily, by Quiver Quantitative, a Substack publication with thousands of. This relationship was especially strong among companies that were being heavily-discussed on WallStreetBets. What To Watch For:īed Bath & Beyond’s stock rally on Tuesday came even as yet another analyst turned bearish, with a price target of just $5 per share implying over 75% downside from current price levels. Data-driven insights from WallStreetBets discussion. In our latest newsletter, we found a positive correlation between off-exchange short sales and future returns.

Shares have surged more than 80% in the last three days alone, even amid fresh warnings about the company’s business prospects from Wall Street analysts, the majority of which maintain a “sell” rating on the stock, according to FactSet data.

0 kommentar(er)

0 kommentar(er)